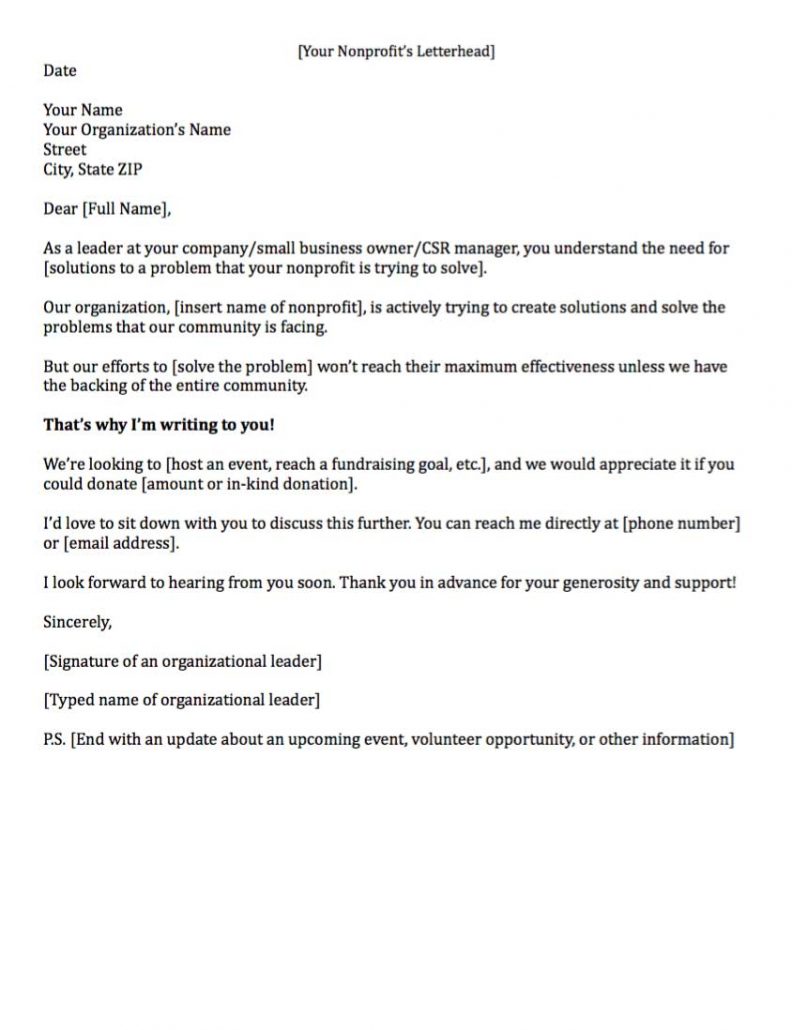

Non Profit Donation Letter. When a tax-exempt entity provides a good or service in exchange for a donation of more than 75 the nonprofit has to 1 provide the donor with written notice of the fair market value of those goods or services received and 2 tell the donor that only a portion of the donation that exceeds the fair market value is tax-deductible. My name is name and describe position situation and background. Zan followed 13 best practices as she developed her new thank you letters for donations goods and services. Nothing says This is a form letter more clearly than failing to include a donors name.

This is your first opportunity to be recognizable and thus trustworthy. 37 Fresh Donation Request Letter for Non Profit Cover letter pointers for brand-new graduates. When it comes to sending donation receipt letters for tax purposes there are two major criteria for nonprofits. Zan followed 13 best practices as she developed her new thank you letters for donations goods and services. In lieu of monetary support you can also ask supporters to start a peer-to-peer fundraiser on behalf of your organization. Why is sending end-of-year donation letters important.

In lieu of monetary support you can also ask supporters to start a peer-to-peer fundraiser on behalf of your organization.

Donation letters can serve as the gateway towards opportunities that might not have existed otherwise. One way of meeting your financial demands as an organization is by writing a donation request letter also known as a fundraising letter. Use the donors name. How to Write with Samples If you work in a charity or any other non-profit organization chances are that you will need some fundraising in order to reach your vision and missions. The donor may use this letter as proof of his or her contribution and claim a tax deduction. Include your organizations contact information at the top of the letter to facilitate easy replies.